how much does it cost to short a stock on td ameritrade

What are TD Ameritrade Tier 2 options. The fees are built into the spread 13 pips is the average spread cost during peak trading hours.

:max_bytes(150000):strip_icc()/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

Bid Ask Size Understanding Stock Quote Numbers

MarketEdge Daily costs 999 while the Plus version costs an extra 10.

. 4999 per transaction although there are also ca. Shorting a stock is as simple as buying and selling any other publicly traded stock on TD Ameritrades website. Then fund your account.

How to short stock w Td Ameritrade 3 minFacebook. Covered calls are an option trading strategy where we sell a call option against 100 shares of stock we ownCash-secured. Typically investors buy stocks they think will go up in price allowing them to sell it at a higher price and keep the difference as profit.

Smart Options Strategies shows how to safely trade options on a shoestring budget. For options you can buy a put or sell a call. However there is a 2000 minimum for margin accounts.

TD Ameritrade charges 65 cents per contract for option trades. Although Level II quotes are free at TD Ameritrade Level I quotes cost 24 for professional traders. The fee for margin account balances of less than 10000 is 950 dropping to.

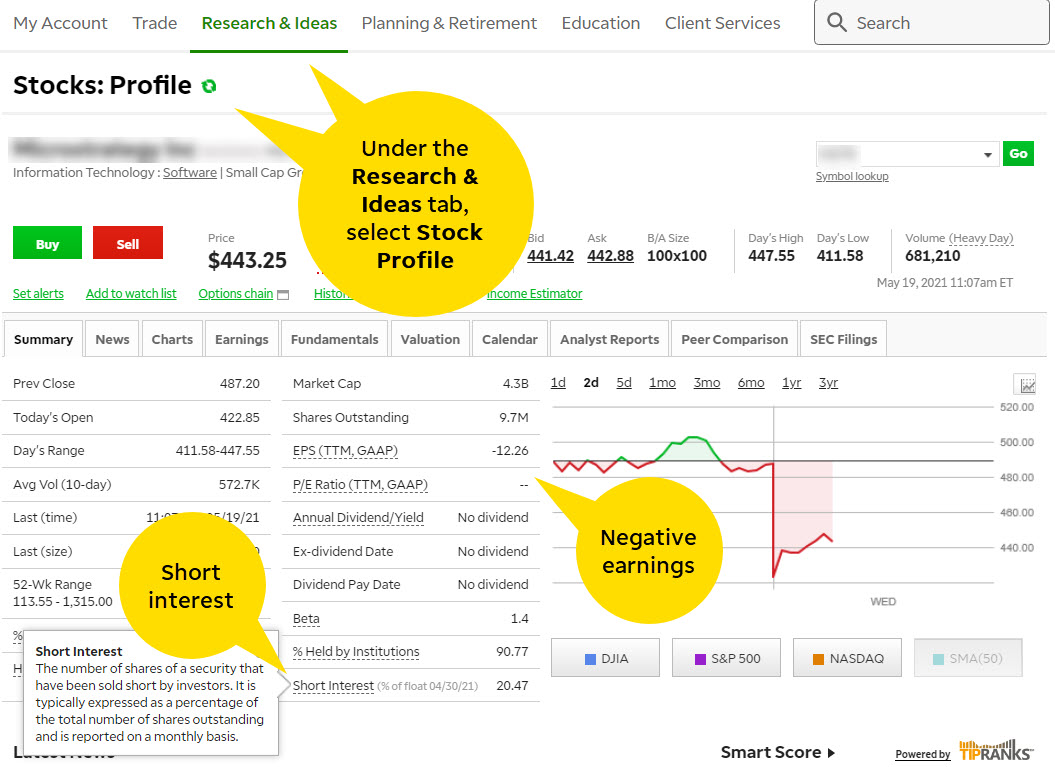

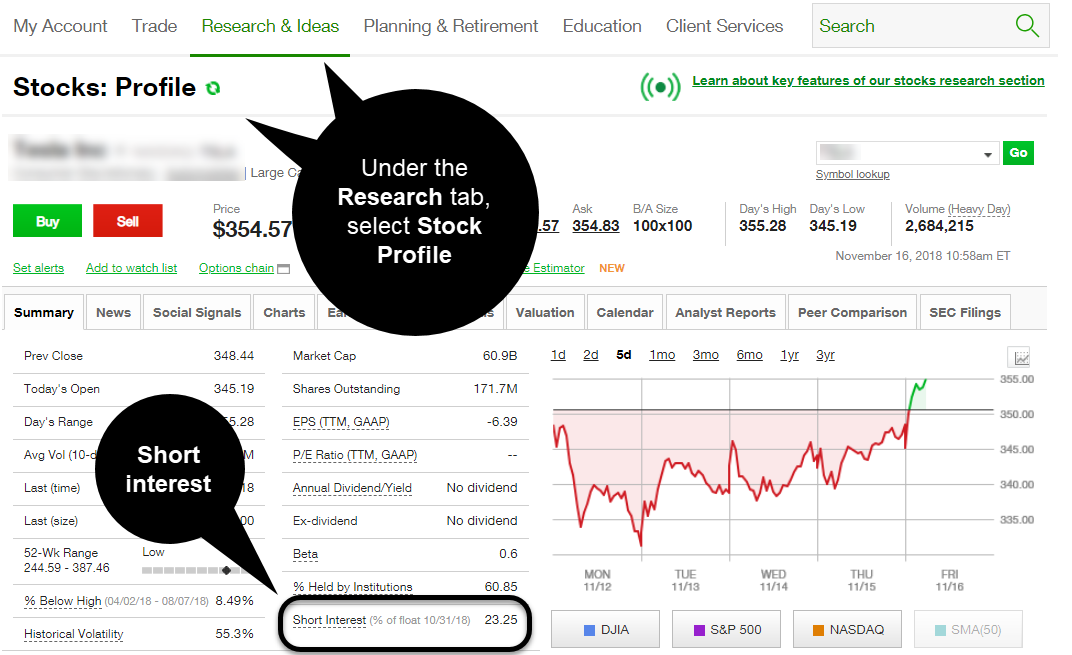

And thats going to cost you. Shorting a stock or short. It is typically expressed as a percentage of the total number of shares outstanding and is reported.

How to short stock w Td Ameritrade 3 minFacebook. Currently the margin fees for TD Ameritrade are between 625 and 9 percent with a base rate of 775 percent. Smart Technology for Confident Trading.

Open a TD Ameritrade Account. Ad How To Trade Options will change how you invest your money - receive it today. Shorting is just a click of the mouse if shares are available.

On Tuesday the discount brokerage Charles Schwab announced it will cut its commission on online stock and exchange-traded fund trading currently 495 per trade to. 1 All service fees are listed in USD and are subject to change. US tech fund fee.

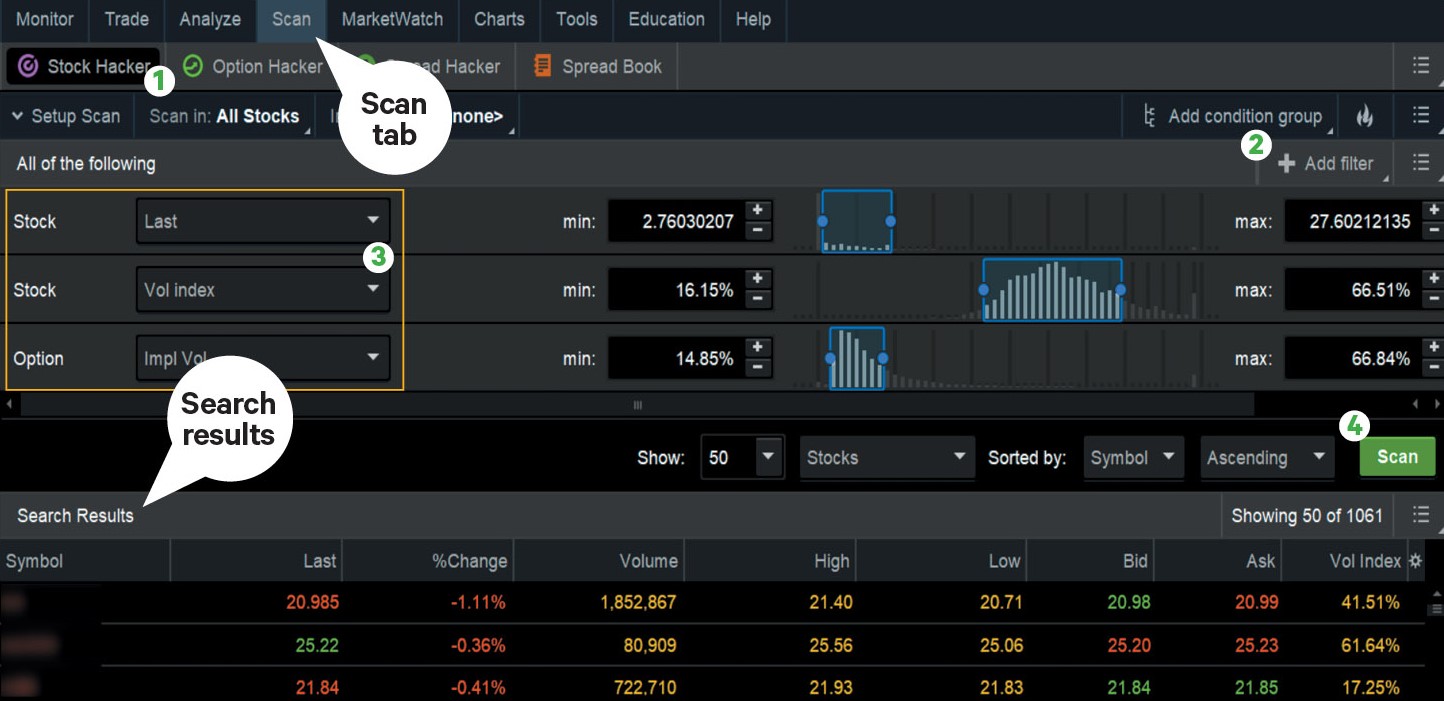

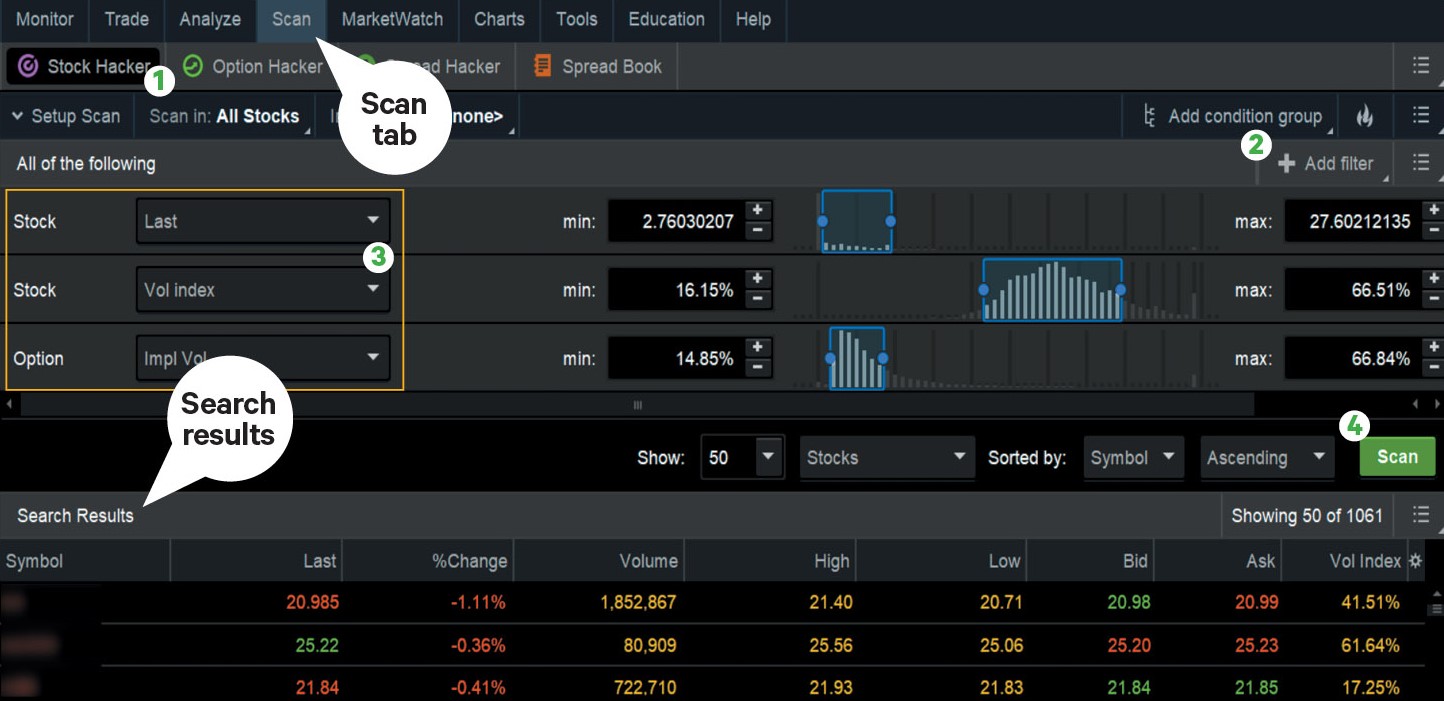

In the below example you can see that we are. TDAs stock commission is a. Ad Download Smart Options Strategies free today to see how to safely trade options.

Get the Answers You Need Online. This is called going long. We deliver added value with our order execution quality with 965 of executed market orders.

I use TD ameritrade for day trading and pennystock trading. How much does fees does TD ameritrade cost you. The question is how many shares.

Learn more on our ETFs page. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2. In order to short sell on TDA you need to be approved for margin and have an account value of 2k.

Answer 1 of 3. No offense but it doesnt really sound like youre that. E-Trade and TD Ameritrade both do a solid job keeping costs low for investors but E-Trade has a slight advantage in a couple areas.

Ad Increased Volatility has Increased Questions. TD Ameritrade charges nearly the highest margin rates of the online brokers we surveyed. TD Ameritrade Short Selling Fees.

One would have to trade at both firms to know the answer to that. Summary of Cost to Open TD Ameritrade Account. Backed By 30 Years Of Experience.

Stocks on the stock market move in two directions. Placing a short sell on TD Ameritrade is similar to how you would place a standard long trade except you will select Sell short for the action. Open a TD Ameritrade Account.

The number of shares of a security that have been sold short by investors. Either choice creates a short position on the underlying stock. Pass-through fees charged to TD Ameritrade Singapore will be passed on to the clients account.

If you are considering opening a TD Ameritrade account there is no reason not to try it out from a cost-perspective since basic. Ad Explore the Latest Features Tools to Become a More Strategic Trader. Tier 2 Standard Cash.

Currently the margin fees for TD Ameritrade are between 625 and 9 percent with a base rate of 775 percent. Emergency Economic Stabilization Act The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost. Get the Answers You Need Online.

TD Ameritrade features an extensive list of commission-free ETFs. Ad Increased Volatility has Increased Questions.

Playing Opposites Why And How Some Pros Go Short On Ticker Tape

Options Trading Concepts Mike His White Board Youtube Option Trading Swing Trading Trading Strategies

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Short Selling Stocks Td Direct Investing

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

Small Account Stock Trading Tiny Doesn T Mean You Ca Ticker Tape

How Google Earns Money Earnings Earn Money Money

87 Stock Portfolio Growth In Just 8 Months Here S How Investing Investment Invest Stockmarket Personalfina Investing Stock Market Investing In Stocks

How I Track Dividend Income In Excel Retire Before Dad Dividend Income Dividend Online Broker

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Charles Schwab Just Made Stock Trading Free Here S Why That Might Be Bad News For Investors Investing Online Trading Interactive Brokers

How Much Am I Charged For A Partial Fill And How To Avoid Partial Executions Money Sense Online Broker Things To Sell

Robinhood Backlash What You Should Know About The Gamestop Stock Controversy Cnet

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2022

Td Ameritrade Shorting Stocks How To Short Sell 2022

Value 3d Rendering Of A Compass With The Word Value Sponsored Rendering Compass Word Ad Value Stocks Creative Typography Design Compass

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

This Common 401 K Oversight Could Cost You Big Time In Retirement Financial Planner Wealth Management How To Plan

The Short And Long Of It Your Top Questions On Short Ticker Tape